Performance over one year is not indicative of a fund’s worth. Even so, most financial advisers recommend that investors review their portfolios annually and the festive break is, for some, a convenient time to assess whether funds have done what they say on the tin in the past year and if they are satisfied with them overall. Returns are likely to be part of their considerations.

Every December at Trustnet, we publish fund picks for cautious, balanced and adventurous investors, as well as for income seekers; we also ask experts for the one fund they would buy for the year ahead, or the one fund they are interested in at the moment. Last year, this amounted to 37 funds being selected and 33 of them have made a positive return so far this year.

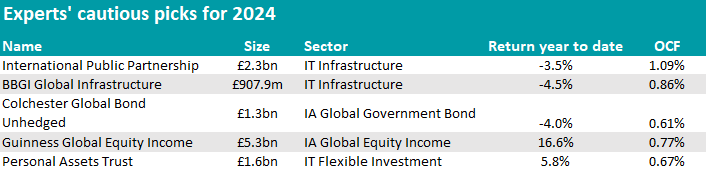

Below, we review how those picks panned out over the year to date, beginning with those for the more risk-averse.

Source: FE Analytics

The highest returns came from the $6.8bn Guinness Global Equity Income fund, co-managed by Ian Mortimer and Matthew Page, which returned more than 16%.

FE Investments analysts praised the manager duo, who bring “bring considerable intellectual heft to the strategy”, as well as consistent best-in-class performance over a long period and a “well-defined, robust and repeatable” process.

“The ability to protect capital in downturns, but crucially also keep up and sometimes outperform in upswings, is highly appealing as is the below-average cost relative to peers,” they said.

Several of our cautious fund picks underperformed, however, with three strategies in the red – International Public Partnerships, Colchester Global Bond and BBGI Global Infrastructure.

The BBGI fund lost 4.5% in 2024 but is still thought to be a good choice going forward for investors looking for an alternative source of income.

Shayan Ratnasingam, senior research analyst at Gravis, recently highlighted its “super-core” infrastructure exposure, which “provides defensive income underpinned by stable and predictable availability-based public sector-backed contracted revenues”.

Remaining in the IT Infrastructure sector, International Public Partnerships was down 3.5% over the same period.

In its latest update this month, the trust reported modest negative impacts on net asset value due to macro factors, reaffirmed its 2024 dividend target with plans for quarterly payments from 2025 and noted a reduction in its corporate debt facility.

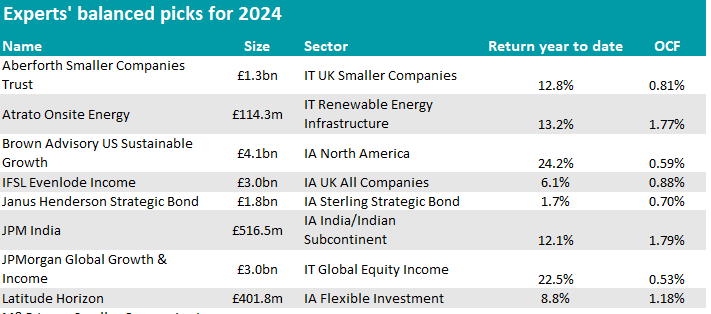

None of the funds suggested for balanced investors made a loss this year, but the spread between the top fund and the bottom was significant.

Source: FE Analytics

Leading the pack at 24.2% was Brown Advisory US Sustainable Growth, whose holding in Nvidia – alongside 36 other names – propped it up this year.

It is managed by David Powell and Karina Funk who, according to FE Investments analysts, have solid long-term track records. Their investment style is best suited to buoyant market conditions, given the incorporation of sustainable principles that give a bias towards higher-quality growth companies.

Close at its heels was JP Morgan Global Growth and Income, at 22.5%.

At the foot of the list, the £1.8bn Janus Henderson Strategic Bond fund made only 1.7% over the year to date. It has also ranked in the bottom decile of the IA Sterling Strategic Bond sector over the past 10, five and three years. In absolute terms, it returned -11.9% over three years, -3.41% over five and 18.5% over 10.

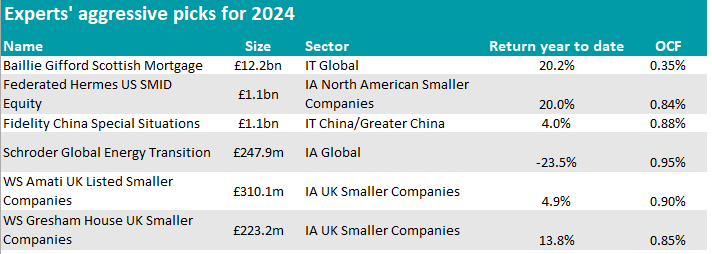

Moving on to the funds singled out for more adventurous investors, none shot the lights out. The best performer was Scottish Mortgage, whose 20.2% growth, however, didn’t match the Brown Advisory US Sustainable Growth portfolio – a choice for medium risk investors.

Source: FE Analytics

In a report published last month by Jefferies, equity analysts Matthew Hose and Fiona Huang marked the trust as a buy after it reduced its allocation to private companies, which they said “points to a wider implied discount on the private portfolio, despite extensive validation of the marks and improving IPO prospects”.

Just two basis points below Scottish Mortgage, the $1.4bn Federated Hermes US SMID Equity has gained a maximum FE fundinfo Crown Rating of five, on the back of its top-quartile three-year performance, among other reasons.

Two more smaller companies funds appeared in the list, this time in the UK – WS Gresham House UK Smaller Companies (13.8%) and WS Amati UK Listed Smaller Companies (4.9%).

In this list of positive performers, Schroder Global Energy Transition was the odd one out, having fallen 23.5% over the year to date, the largest decrease out of all funds that appeared on Trustnet last December.

Launched in December 2020, the strategy is co-managed by Mark Lacey, Alex Monk and Felix Odey.

According to Square Mile analysts, the fund has “a lot of promising features and has made a strong start to life”, but its investment universe, as with many more recently launched responsible strategies, is “untested by the passage of time”.

“Additionally, the clean energy space continues to be dependent on further capital investment and commitment from governments and society at large, with many of the firms in this space remaining at the developmental stages and therefore subject to both significant opportunities and risks,” they said.

However, the vehicle has remained approximately 20 percentage point ahead of its benchmark, the MSCI Global Alternative Energy index, and the analysts believe it can continue to outperform it and the MSCI ACWI index over rolling fiveyear periods.

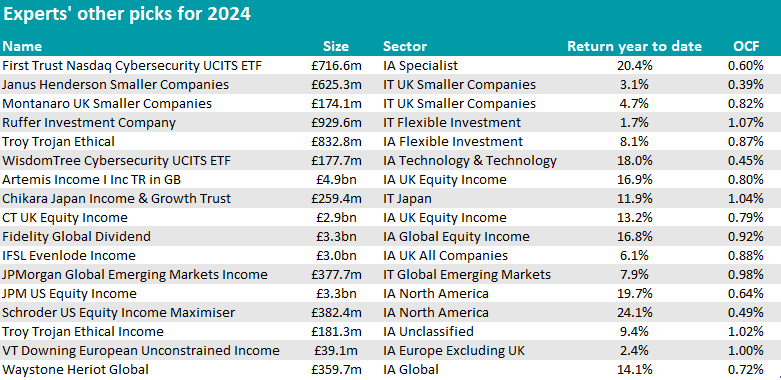

Source: FE Analytics